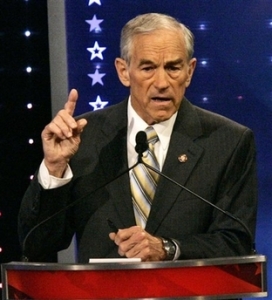

By an overwhelming margin, the Republican-controlled U.S. House of Representatives yesterday passed a bill modeled after former congressman Ron Paul’s “Audit the Fed” legislation. With 106 Democrats supporting the bill, the “Federal Reserve Transparency Act” was approved by a bipartisan vote of 333-92.

By an overwhelming margin, the Republican-controlled U.S. House of Representatives yesterday passed a bill modeled after former congressman Ron Paul’s “Audit the Fed” legislation. With 106 Democrats supporting the bill, the “Federal Reserve Transparency Act” was approved by a bipartisan vote of 333-92.

A similar measure was passed in the House in 2012 during Paul’s final year in Congress.

Wall Street isn’t worried as the legislation — long championed by the former Texas congressman — is expected to be DOA in the Democratic-controlled Senate.

For all intents and purposes, it was largely a symbolic vote to give members of the House cover in this year’s mid-term election. Most Americans are still upset with Wall Street — and the lawmakers know it.

Auditing the Fed is the least Congress could do, especially since it can’t seem to do much else.

The new measure, sponsored by right-wing Rep. Paul Broun of Georgia, would require the nonpartisan Government Accountability Office (GAO) to conduct an audit of the Federal Reserve Board and its twelve Federal Reserve Banks within a year of its enactment.

It would also require the GAO to audit the Federal Reserve’s internal reviews of homeowners who were in foreclosure in 2009 and 2010, a requirement of the enforcement actions taken by the central bank against financial institutions at the time — the same firms that were primarily responsible for the 2008 financial meltdown and the ensuing “Great Recession” from which the nation has not yet fully recovered.

“Today’s passage of the ‘Audit the Fed’ bill brings us one step closer towards bringing much-needed transparency to our nation’s monetary policy,” said Broun. “For the past 100 years, the Federal Reserve, a quasi-government agency, has acted under a veil of secrecy, controlling our monetary policy and thus our economy.’

He’s right, but an audit is unlikely to change that fact.

While an annual audit might expose some — and only some — of what writer William Greider once described as “the secrets of the Temple,” it wouldn’t do anything to change the fact that Wall Street has almost total control over the U.S. economy, including the country’s money supply. That should be clear to everyone. While providing lip service to national concerns like unemployment, inflation and income inequality, the Federal Reserve is a private entity and largely benefits private banking interests. A great example was the Fed’s policy of quantitative easing — QE1, QE2 and QE3, the largest bailout ever — which artificially propped up the world’s financial markets and only benefitted one segment of the economy. And it surely wasn’t the 99%.

In any case, a companion “Audit the Fed” bill has been introduced in the U.S. Senate by Sen. Rand Paul of Kentucky, the former congressman’s son and a possible contender for the GOP presidential nomination in 2016. It currently has thirty co-sponsors, but most Senate observers believe there’s little to no chance it will be seriously considered before the end of the year.

Reacting to yesterday’s vote, Ron Paul himself sallied forth to say that he was “pleased to see the House of Representatives once again pass this historic legislation. The support ‘Audit the Fed’ has received over the past few years has been tremendous,” he said. In his statement, the 79-year-old former congressman and three-time presidential candidate strongly urged Senate Majority Leader Harry Reid “to listen to the American people and hold a vote on ‘Audit the Fed’ right away.”

He shouldn’t hold his breath.

While an audit would be nice, nationalization — making the private banking cartel work as a national bank on behalf of the American people instead of Wall Street and the financial oligarchy, as Alexander Hamilton and the Founding Fathers anticipated and which was later championed by Philadelphia’s Henry C. Carey, Abraham Lincoln’s chief economic advisor — would be better. Much better.

Follow Us